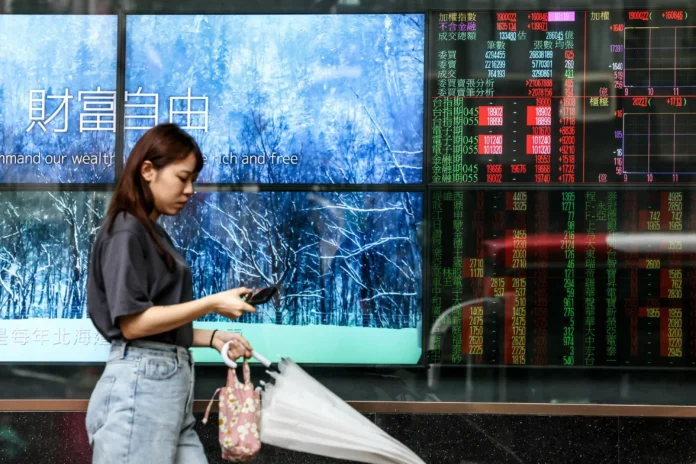

World markets saw a significant rebound on Thursday, with Japan’s benchmark index jumping more than 9%. This surge in the market was largely due to the positive response from investors to U.S. President Donald Trump’s decision to delay the latest round of tariff hikes on Chinese goods.

The news of the delay came as a relief to investors who have been closely monitoring the ongoing trade tensions between the world’s two largest economies. The initial plan was for the U.S. to impose a 10% tariff on $300 billion worth of Chinese goods starting September 1st. However, President Trump announced on Tuesday that these tariffs will now be implemented on December 15th, giving both countries more time to negotiate a trade deal.

This announcement was met with a wave of optimism in the global markets, as investors saw it as a step towards de-escalating the trade war between the U.S. and China. The Japanese benchmark index, Nikkei, closed at a 4-month high, while other Asian markets also saw a surge in their indices. This positive sentiment was also reflected in the European markets, with major indices such as the FTSE 100 and DAX recording gains of over 1%.

The U.S. markets also responded positively to the news, with the Dow Jones Industrial Average rising by more than 1%. This comes as a welcome relief after weeks of volatility and uncertainty caused by the trade tensions between the U.S. and China.

The delay in tariffs has also been seen as a positive sign for the global economy, as it gives businesses more time to adjust to the potential impact of the tariffs. Many companies have been concerned about the rising costs of imports and the potential impact on their bottom line. This delay gives them more time to plan and adapt to the changing trade landscape.

Moreover, the delay in tariffs has also been seen as a sign of progress in the trade negotiations between the U.S. and China. Both countries have been engaged in a trade war for over a year now, with each imposing tariffs on billions of dollars worth of goods from the other. This has not only affected the two countries but has also had a ripple effect on the global economy.

The decision to delay the tariffs shows that both sides are willing to continue negotiating and find a resolution to the trade dispute. This has given investors hope that a trade deal could be reached in the near future, which would be beneficial for both countries and the global economy as a whole.

In addition to the positive response from the markets, the delay in tariffs has also been welcomed by businesses and industry leaders. Many have expressed their relief and optimism, stating that the delay gives them more time to prepare and could potentially lead to a more favorable outcome in the trade negotiations.

However, it is important to note that the trade tensions between the U.S. and China are far from over. The delay in tariffs is just a temporary measure and the two countries still have a long way to go in reaching a comprehensive trade deal. But the positive response from the markets and the business community shows that there is still hope for a resolution to this ongoing trade dispute.

In conclusion, the rebound in world markets on Thursday was a clear indication of the positive impact of President Trump’s decision to delay the latest round of tariffs on Chinese goods. This move has not only eased tensions between the two countries but has also given investors and businesses a much-needed breather. It is now up to the U.S. and China to continue their negotiations and work towards finding a long-term solution that benefits both sides and the global economy.